Wells Fargo Mobile Deposit

- Banks With Instant Mobile Deposit

- Wells Fargo Mobile Deposit Limits

- Wells Fargo App Online

- Wells Fargo Mobile Deposit

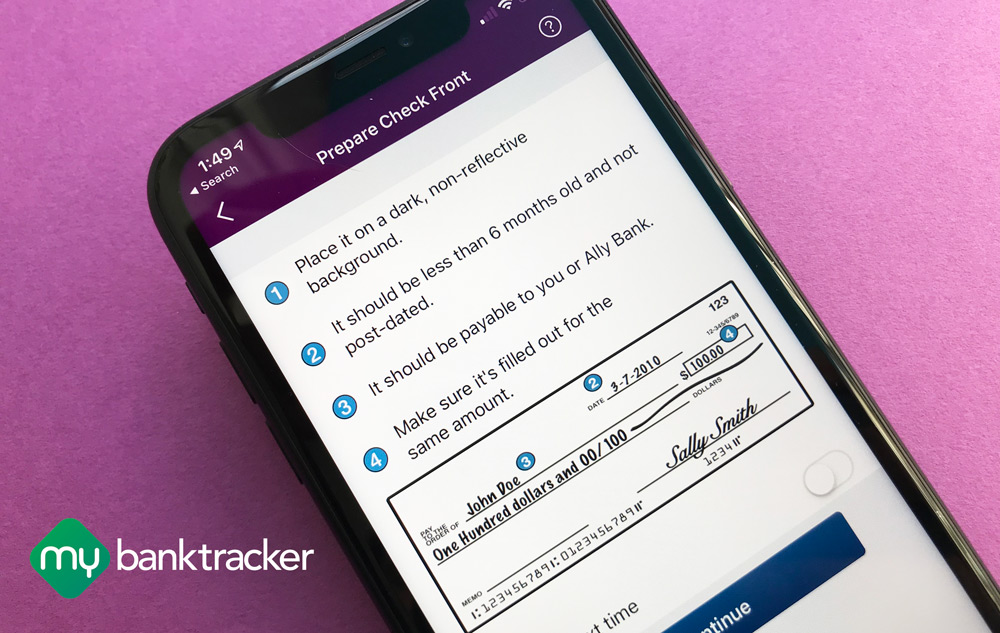

Wells Fargo mobile deposit gives you a fast and secure way to add funds to your deposit accounts using the camera on your phone or other mobile device. In most cases, the deposited funds are available to you the day after the deposit is credited. Your bank can cap how much you can deposit. Banks will typically place a limit on the dollar amount. Mobile check deposit allows you to save time by depositing your checks remotely, no matter where you are or what time of day it is. Instead of making a run to the bank, you can simply snap a. Oct 11, 2020 For example, the Wells Fargo mobile app shows you your mobile deposit limit after you select a deposit account and enter the deposit amount. Your limit might be raised if your account has been open for several years without a problem, and you can try asking to have it increased.

Managing your savings and checking accounts can be a lot easier these days thanks to innovations like online and mobile banking. One of the newest tools that banks are rolling out is mobile deposit, which allows you to add money to your account by taking a picture of it with your smartphone.

While mobile deposit can be convenient, it’s not without certain drawbacks. SmartAsset takes a brief look at the potential disadvantages of using mobile deposit.

1. It Can Take Longer for Funds to Hit Your Account

Generally, when you deposit a check at the drive-thru or teller window, you can expect to see at least some of the money credited to your account that same day. When you deposit a check from your mobile device, it may take a little longer for your funds to become available based on what time of day the deposit was made. For example, mobile check deposits made after 6 p.m. Pacific time on business days to at least one major bank can’t be used until two business days later.

Aside from the processing cutoff times, there are a few other things that can potentially affect how long it takes for the money to show up in your account. If you’re a new customer, you’ve racked up multiple overdraft charges, the deposit is for more than a certain dollar amount (say $50,000) or the bank believes that the check won’t be honored, you may have to wait as long as a week for it to be verified before the deposit clears.

2. Some Banks Limit How Much You Can Deposit

Mobile deposit’s usefulness may only go so far if you’ve got multiple checks you need to deposit each month. Some banks require you to make your deposits at an ATM or in-person at a branch once you reach a certain number of transactions or a specific dollar amount.

Each bank sets its own policy on how much you can deposit from your mobile device and in some cases, it depends on how long you’ve been a customer. SunTrust, for instance, limits mobile check deposits to $1,000 per check and $3,000 per month if your account has been open for six months or less. At Citibank, the limit for new account holders is $500 per day or $1,500 per month.

3. You May Be Charged a Fee

While most banks offer mobile deposit services at no charge, others impose a small fee. At least one major bank charges a fee, currently set at $0.50 per transaction. You may have to pay a fee if you have an account at a smaller community bank or credit union, so it’s a good idea to read over your account agreement before you begin using mobile deposit. While it doesn’t seem like a lot, you could easily be nickel and diming yourself if you use mobile deposit on a regular basis.

4. Security Is Not 100% Guaranteed

Banks are more cautious than ever these days when it comes to protecting their customers’ information but there’s always the possibility that a cyber thief could get his or her hands on your account details if you use mobile deposit.

To minimize the risk, it’s a good idea to avoid storing your username or password in your phone’s app and only log in to mobile banking services using a secure connection. Something as simple as putting a lock code on your smartphone can keep a random stranger from accessing your account if your phone gets lost or stolen.

Final Word

If you don’t have time to stand in line at the bank, mobile deposit can be an efficient way to manage your money. Just be sure you’re clear on what your bank’s policies are before you start snapping away with your phone.

Update: Have more financial questions? SmartAsset can help. So many people reached out to us looking for tax and long-term financial planning help, we started our own matching service to help you find a financial advisor. The SmartAdvisor matching tool can help you find a person to work with to meet your needs. First you’ll answer a series of questions about your situation and goals. Then the program will narrow down your options from thousands of advisors to up to three fiduciaries who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

Photo credit: flickr

Solutions if Wells Fargo Mobile App Not Working

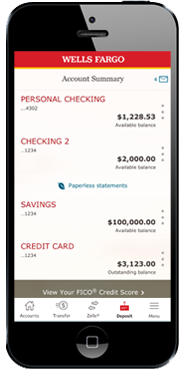

What to do if Wells Fargo mobile app not working in your mobile phone (whether you are using android phones, smart phones, Samsung, iPhone, Windows, etc)? I do believe you know already the benefits and features of Wells Fargo mobile app. In this mobile app, you can transfer funds, you can pay bills online, and you can also check your balance.

However, there are times you can experience “errors” or “inconvenience”. To resolve whatever issues or problems when using this mobile app, relax and follow this simple things.

Wells Fargo Mobile App Not Working

Banks With Instant Mobile Deposit

Here are the things to do if something goes wrong with Wells Fargo mobile app in your device. It is up to you if you will follow this tips or not.

Wells Fargo Mobile Deposit Limits

- Delete your Wells Fargo mobile app and install it again. As a guide, you can see the instructions on how to download Wells Fargo mobile app on Google Play.

- If the mobile app is still not working, keep on reading.

- Go to WellsFargoCommunity.com. Visit customer support, press Mobile Banking and read some useful tutorials.

- Browse questions, read answers and learn. If your issues aren’t already asked, start asking a question and you will get immediate response with appropriate answer.

Here’s some of the useful “conversation” when a customers has problem related to APP CHECK DEPOSIT NOT WORKING. And here is the response from other members or community admin and moderators;

Hi there,

I am not sure why your deposit is not working, if it’s due to the technology or the issue of changing up your debit card due to fraud, or something else.

Wells Fargo App Online

It is Monday now. You can call our Online Banking support number and get more help on your mobile deposit functionality and perhaps they can isolate more why it is not working.

Online Banking Support

1-800-956-4442

24 hours a day, 7 days a week

Source: https://www.wellsfargocommunity.com/thread/6613

Join WellsFargoCommunity.com to find an exact solution if your mobile app is not working in your preferred device.

Wells Fargo Mobile Deposit

Wells Fargo Community – Join and Look for the Solution for Not Working Mobile Application

Join WellsFargoCommunity.com to find an exact solution if your mobile app is not working in your preferred device. Now, you know what to do if the WellsFargo mobile app not working in your devices.

- You might also like to read the online banking reviews for Wells Fargo.

- Useful resource: Wells Fargo Online Community

Do you have any question, please use the comment box. Do not forget to share this article with your friends or to anyone who loves to use Wells Fargo mobile application.

Update: Wells Fargo Mobile App Not Working

Try to read the statements of Wells Fargo in their official website about their mobile banking app or just read the frequently asked questions below; Is Wells Fargo App supported in different devices? YES, it has a custom app for Android, iPad, and iPhone devices.