Cash Cheque Online

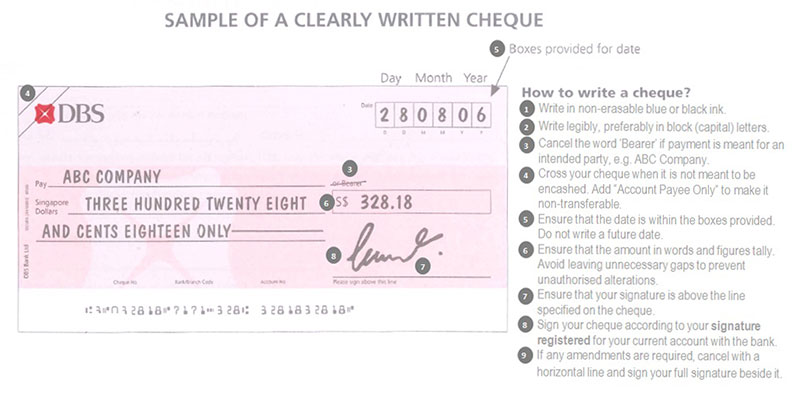

Cash a Check service in the PayPal app allows you to cash checks and have them credited to your PayPal Cash Plus account, using the PayPal app on your mobile device. You simply take a picture of the check you want to cash, and send it to us for review. If your check is approved, you have the option to pay a fee and get your money credited to. The cheque is in date; The cheque has been signed and dated; The cheque has both the words and figures on the front of the cheque and that these match; That both the sort code and account number is included on the back of the cheque on the right hand side (we will pay the cheque to the account confirmed on the back of the cheque). The cheque might still have been paid in. You can check by selecting ‘View cheques paid in’. If you can see your cheque there, it worked. If it didn’t work, try paying it in again when you’re in an area with better reception. And don’t worry, you can’t pay in the same cheque twice – we’ll warn you if you try to do that. Paying in a cheque. You can pay cheques into your Monzo account by posting them to us. We recommend sending your cheques in a 1st/2nd class stamped envelope (or tracked mail to be extra safe!) We also have a Freepost service you can use, but this can take up to 10 working days for your cheques to reach us. How to Cash a Third Party Check Online Instantly. Most of the ways that involve instant online check cashing involve the use of your phone. Cashing a third party check instantly now involves using a smartphone. This saves a tremendous amount of time cashing a check online versus going to a.

Cash paychecks, personal checks, business checks, money orders and more, anytime, anywhere. Get your money in minutes in the accounts you choose, as good as cash and safe to spend!

With Ingo Money, it’s your money on your terms.

All checks subject to review for approval. Fees may apply.

INGO MONEY APP

Cash a check on your mobile device.

Get your money in minutes in most bank, PayPal or prepaid card accounts, buy an Amazon.com Gift Card, pay credit cards or pick up cash at a MoneyGram agent location.

No check cashing lines. No take-backs. No worries.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal account, buy an Amazon.com Gift Card, pay credit card bills or pick up cash at a MoneyGram agent location.

No check cashing lines. No take-backs. No worries.

Simply link your accounts in the Ingo Money App, cash a check and choose where you want to send your money. Or split a check and send money to more than one place.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

HOW THE APP WORKS

Cash a check in three easy steps.

Take pictures of your check

Choose when you want your money

Choose where to send your money

Fund most bank, prepaid or PayPal accounts, pay credit cards or split a check to multiple accounts

- Sign in and tap ‘Cash a Check’

- Take a photo of the front and back of your check

- Choose WHEN you want your money

- Choose WHERE you want your money

- Submit your check for review

The review process typically takes just a few minutes. If your check is approved, you may also be asked to void it and submit a voided image.

Take pictures of your check

Choose when you want your money

Choose where to send your money

Fund most bank, prepaid or PayPal accounts, pay credit cards or split a check to multiple accounts

Download the Ingo Money App

Enroll to create your user profile

Link debit, prepaid, credit card and PayPal accounts

Your’re ready to Ingo

Cash checks in minutes for a fee; in 10 days for free

Download the Ingo Money App

Enroll to create your user profile

Link debit, prepaid, credit card and PayPal accounts

Your’re ready to Ingo

Cash checks in minutes for a fee; in 10 days for free

GET THE APP

Install the Ingo Money App and create your user profile.

Download

Install the app from the App Store℠ or the Google Play™ Store. Data rates may apply.

Enroll

Create your user profile and link your debit card, prepaid card, PayPal and credit card accounts.

Snap

Follow the screen prompts to snap a photo of the front and back of your check.

Go

Get your money in minutes for a fee or in 10 days for no fee. Whichever option you choose, if your check is approved and your account is funded, your money is as good as cash and safe to spend.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

FAQCONTACT USCAREERS

SUPPORTED ACCOUNTS & NETWORKS

The Ingo Money App may be used by identity-verified customers to cash checks issued on U.S. financial accounts to fund: (1) most debit, prepaid and credit card accounts issued by hundreds of U.S. financial institutions including Chase®, Bank of America®, Citi®, Wells Fargo®, American Express®, U.S. Bank®, PNC Bank®, Capital One®, HSBC Bank USA, TD Bank, Discover®, Synchrony Bank, First Premier® Bank, MetaBank® and The Bancorp Bank; (2) PayPal™, PayPal™ for Business and PayPal™ Prepaid MasterCard® accounts; (3) Amazon.com Gift Cards; (4) most prepaid cards, including Chase Liquid®, Wells Fargo EasyPay®, Regions Now Card®, BB&T MoneyAccount®, NetSpend®, Green Dot® Prepaid Debit, Walmart MoneyCard®, H&R Block® Emerald Card®, ACE Elite™, RushCard®, AccountNow®, Kroger® 1-2-3 REWARDS®; and (5) cash pick-up at MoneyGram’s participating U.S. locations. Funds may also be used to pay retail credit card bills from thousands of retailers including Walmart®, Target®, Costco®, Home Depot®, Lowe’s®, BestBuy®, Gap® and Old Navy®. You can also access the Ingo Money service in dozens of mobile banking apps including American Express Serve® and Bluebird℠ by American Express. Ingo Money participates in the Visa®, MasterCard®, American Express®, Star®, Pulse®, NYCE® and Maestro® payment networks.

LEGAL DISCLOSURE

Ingo Money is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

Amazon.com Gift Cards (“GCs”) sold by First Century Bank, N.A., an authorized and independent reseller of Amazon.com Gift Cards. Except as required by law, GCs cannot be transferred for value or redeemed for cash. GCs may be used only for purchases of eligible goods at Amazon.com or certain of its affiliated websites. For complete terms and conditions, see www.amazon.com/gc-legal. GCs are issued by ACI Gift Cards, Inc., a Washington corporation. All Amazon ®, ™ & © are IP of Amazon.com, Inc. or its affiliates. No expiration date or service fees.

Cash pick-up service is provided by MoneyGram Payment Systems, Inc., subject to the MoneyGram Terms and Conditions available at https://www.moneygram.com/us/en/terms-and-conditions; availability subject to agent operating hours and compliance with regulatory requirements. MoneyGram cash payout transactions are available between $5.00 and $1,000.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with these companies. All rights reserved.

© 2013 – 2020 Ingo Money, Inc.

© Joe Raedle/Getty Images 4 Ways to cash a check without a checking accountIf you have a checking or savings account at a federally insured bank, you should have no trouble cashing a check there.

But for the millions of people without a bank account, check cashing is not as easy. Approximately 8.4 million U.S. households, comprising 14.1 million adults, don’t have a bank account, according to a 2017 survey from the Federal Deposit Insurance Corporation.

There are ways to cash a check without a bank account, but they cost more money, often require more time and involve more risk than check cashing at a bank where you have an account. Here are five options:

1. Check cashing at the issuing bank

Banks and credit unions are not required to cash checks for non-customers, but many banks will cash a check payable to a non-customer if the check is written by an account holder at that bank.

There are a few requirements though. For one, there must be enough money in the account the check is written against to cover the check. The payee will need to show identification, such as a driver’s license or military ID.

The payee also should expect to pay a fee. Check-cashing fees at traditional banks hover around $8. If you get paid 52 weeks a year, that’s $416 in check-cashing charges.

And there may be restrictions, such as limits on check amounts and refusal of two-party personal checks. Checks that are six months old or more might be declined.

2. Check cashing at a retailer

There are a number of big retail stores like Kmart, Walmart and grocery chains that offer check-cashing services.

The least expensive option is probably Kmart, if you can find one that hasn’t closed. The struggling retailer charges only $1 or less to cash checks, including two-party personal checks up to $500. The caveat is that you need to be a member of the store's 'Shop Your Way' program to use the service. Joining the program is free.

Walmart charges $4 to cash checks up to $1,000 and up to $8 for checks more than that amount. Walmart also cashes two-party personal checks, but it limits them to $200 and charges a $6 max fee.

Grocery chains often provide check-cashing services. Kroger, Publix, Giant Eagle, Albertsons and Ingles, to name a few, cash checks. Fees typically range from about $3 to $6.

3. Loading funds onto a prepaid debit card

Video: 5 Things To Downsize Before You Retire (GOBankingRates)

People who don't have bank accounts sometimes use prepaid cards to deposit checks and access their cash. Prepaid cards are similar to checking account debit cards. Your spending is limited by how much money you have loaded onto the card.

Prepaid cards have different options for check cashing. Some prepaid cards let you set up direct deposit so that checks are automatically loaded onto the card. Other cards come with an app that lets you snap a picture of your check to load it onto your card. Or, you might be able to deposit your check at an ATM to load the money onto the card.

Cash Check Online Instant

Fees are a big drawback of prepaid cards. The Walmart MoneyCard charges $2.50 to withdraw money at an ATM (not including the fee the bank charges) or a bank teller window, and 50 cents to check your card balance at an ATM. There is a monthly fee of $5.94 unless you load $1,000 a month onto the card.

Reload fees can be steep. It can cost you up to $5.95 to add money to a Green Dot Prepaid Visa card. Green Dot also charges a $3 ATM fee. Sometimes, prepaid card fees are scaled according to how quickly you want your money, and you can get dinged for expedited availability.

4. Cashing your check at a check-cashing outlet

Check-cashing outlets are probably the most expensive places to cash checks. Some of them require customers to become “members” or to buy check-cashing ID cards before they will cash your checks. In addition to a membership fee, they might charge a first-time use fee.

Fees to cash a check can range from 1 percent to 12 percent of the face value of the check. That means you could pay from $10 to $120 to cash a $1,000 check. Some businesses charge a flat fee on top of the percentage.

The average face value of a check presented to a check-cashing outlet is $442.30, with the average fee to cash that check being $13.77, or about 3.1 percent, according to the FDIC. If that’s your paycheck and you cash it every week, you’ll pay $55.08 a month, or $661 a year, in check-cashing fees

Not only are check-cashing stores exorbitantly expensive, there is a risk of deceptive practices. The Better Business Bureau, for example, alerts consumers to a scam whereby customers of a check-cashing store are called by someone who claims to represent the business. The caller offers the customer a loan and requests payment to secure the loan. Of course, the loan is never received and the customer of the check-cashing store gets scammed out of some cash.

Check-cashing stores should be your last resort.

5. Sign your check over to someone you trust

Another way to cash a check if you don’t have a bank account is to sign the check over to someone you trust who does have a bank account and have that person cash the check at their bank.

Cash Cheque Online Barclays

Make sure the person you want to sign it over to is willing to cash the check, and that his or her bank will cash it. You should accompany your trusted friend to the bank in case the teller requires your ID or has questions about the check.

The person must have the proper identification and be prepared to have his or her check dinged by a check-cashing fee. There is also a personal and financial safety risk. Paper checks and cash can be lost or stolen.

Bottom line

Turning that paper check into cash in your hands is trickier if you don’t have a bank account. Unlike the consumer who has a bank account and direct deposit of their income, unbanked consumers almost have to plan ahead to cash their checks and access their money.

It’s fairly easy to find a bank or other business that will cash your check if you don’t have a bank account. But there will be fees and restrictions. And there are risks associated with carrying checks and cash.

Cash Cheque Online Tsb

The best way to cash checks is by opening a checking or savings account at a federally insured bank or credit union, then setting up direct deposit of your payroll check, tax refund, pension benefit and other income. Not only is it safer and easier, it will cost you less.